In this article, we will discuss LIC’s New Jeevan Anand Policy no. 915 its Benefits, Eligibility, Taxes, Policy Loans, etc.

Table of Contents

Benefits of LIC Jeevan Anand Policy

LIC New Jeevan Anand is a non-linked life assurance plan for an individual that offers an attractive combination of protection and savings. Your family gets financial protection against death throughout the lifetime of the policyholder. At the end of the policy term, the individual will get a lump sum amount in case of his/her survival. The following are the benefits that make this policy worth buying-

Death Benefits in LIC New Jeevan Anand Plan 915

During the Policy Term-

Your family will be entitled to receive “Sum Assured on Death” along with vested Simple Reversionary Bonuses and Final Additional bonus (if any). The sum assured will be 125% of the Basic Sum Assured or 7 times of annualized premium whichever is higher. The death benefits shall not be less than 105% of total premiums paid up to date of death.

After Policy Term

After the end of the policy term, you are still entitled to receive the death benefit of Basic Sum Assured.

Maturity Benefits in New Jeevan Anand Plan

At the time of maturity, the individual is entitled to receive “Sum Assured on Maturity” along with vested Simple Reversionary Bonuses and Final Additional Bonus (if any). The sum assured on maturity is equal to the Basic Sum Assured.

Optional Benefits:

You can also subscribe to additional optional benefits to enhance your policy and increase security. The following are the optional benefits that you can subscribe to-

Rider Benefits:

You can opt for a rider’s benefit which protects you in case of an accident. Along with the New Jeevan Anand policy, you can also avail of additional three-rider benefit by paying an additional premium amount-

- LIC’s Accidental Death and Disability Benefit Rider (UIN: 512B209V02) or LIC’s Accident Benefit Rider (UIN:512B203V03)

- LIC’s New Term Assurance Rider (UIN: 512B210V01)

- LIC’s New Critical Illness Benefit Rider (UIN: 512A212V01)

Option to take Death & Maturity Benefits in Installments:

Instead of receiving lumpsum payments of the funds, you can also opt for death and maturity benefits in the form of installments. The following are the mode of installment payment with minimum installment amount-

| Mode of Instalment payment | Minimum installment amount |

| Monthly | Rs.5,000/- |

| Quarterly | Rs.15,000/- |

| Half-Yearly | Rs.25,000/- |

| Yearly | Rs.50,000/- |

Eligibility for LIC Jeevan Anand Policy 915

The following are the eligibility for LIC Jeevan Anand policy-

| Terms | Conditions |

| Minimum Basic Sum Assured | 100000 |

| Maximum Basic Sum Assured | No Limit |

| Minimum Age at entry | 18 years |

| Maximum Age at entry | 50 years |

| Maximum Maturity | Age 75 years |

| Minimum Policy | Term 15 years |

| Maximum Policy | Term 35 years |

Premium Payments in Plan 915

The premiums for the policy can be paid in a variety of different modes- monthly, quarterly, half-yearly, or yearly payments.

Grace Period

Grade Period can be defined as the period when the policyholder does not pay the premium but the policy is still in force.

Every LIC policies have a grace period to facilitate the policyholder. In this policy, you get a grace period of 30 days for quarterly, half-yearly, and yearly, and 15 days for the monthly premium payments. The grace period also applies to the rider policy if you are subscribed to it.

Rebates

Rebate can be defined as a return/refund to the policyholder when the premium for the policy has been paid off in a certain premium amount. The following are the rebate table that you can consider-

Mode Rebate

| Yearly mode | 2% of Tabular Premium |

| Half-yearly mode | 1% of Tabular premium |

| Quarterly, Monthly mode & Salary Deduction | NIL |

High Sum Assured Rebate on Permium

| Basic Sum Assured (B.S.A) | Rebate (`) |

| 1, 00,000 to 1, 95,000 | Nil |

| 2, 00,000 to 4, 95,000 | 1.50% of B.S.A. |

| 5, 00,000 and 9, 95,000 | 2.50% of B.S.A. |

| 10, 00,000 and above | 3.00% of B.S.A. |

Revival

If the premiums are not paid during the Grace Period, then the policy will lapse. The lapsed policy can be revived within 5 years from the date of the first non-payment of the premium but before the end of the policy term.

You can revive the policy after paying all the arrear premium payments along with the interest rate compounded half-yearly fixed by the corporation. The corporation can also consider the revival of Rider policy if subscribed.

Taxes in New Jeevan Anand

The policyholder has to pay Statutory Taxes as per the Government norms on the premium paid as per the Tax laws and the rate of tax as applicable from time to time.

Loans Against LIC New Jeevan Anand

You can also avail of the loan against the policy provided at least two full-year premium payments. The maximum loan amount under the policy is as per the percentage of Surrender Value, which is as follows-

- For in-force policies – up to 90% of Surrender Value

- For paid-up policies – up to 80% of Surrender Value

The interest on the loan will be declared by the Corporation based on the method approved by the IRDAI. Any outstanding loan can be recovered from the claim proceeds at the time of exit.

Paid-up Policy

After the grace period has ended, the policy will be collapsed if the premium payment is paid less than two years. In this case, nothing shall be payable by the corporation.

If a two-year premium has been paid, then the policy will not collapse fully and will be continued as a paid-up policy as follows-

During the Policy Term

Death of Policyholder

Under paid-up policy, the Sum Assured on Death will be reduced to Death Paid-up Sum Assured and will be calculated as Sum Assured on Death multiplied by the ratio of the total period for which premiums have already been paid. In addition, vested Simple Reversionary Bonuses (if any) will also be payable on the policyholder’s death.

Maturity

Under paid-up policy, the “Sum Assured on Maturity” will be reduced to the “Maturity Paid-Up Sum Assured” and will be calculated as “Sum Assured on Maturity” multiplied by the ratio of the total period for which premiums have been paid. In addition, vested Simple Reversionary Bonuses(if any) will be paid as well.

After the expiry of Policy Term

After the expiry of the policy term and the unfortunate demise of the policyholder, then a Paid-up Sum Assured equal to Basic Sum Assured multiplied by the ratio of the total period for which premiums have been paid will be returned to the nominee of the policyholder.

Also, the vested Simple Reversionary Bonuses will remain attached to the paid-up policy. Rider do not acquire any paid-up value and the rider benefits cease to apply if the policy is in lapsed condition.

Free Look-up Period

In case, after subscribing to the policy, you do not like the terms or conditions of the policy, you can opt-out of the policy within 15 days from the date of receipt of the policy bond. This period of 15 days is called Free Look-up Period.

The initial premium paid by the policyholder will be returned after deducting the proportionate risk premium and additional documentation charges.

Surrender

You can surrender the policy at any time given you have fully paid two years of premiums. In case of the surrender of the policy, the corporation will pay the surrender value i.e. Guaranteed Surrender Value or Special Surrender Value, whichever is higher.

The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI.

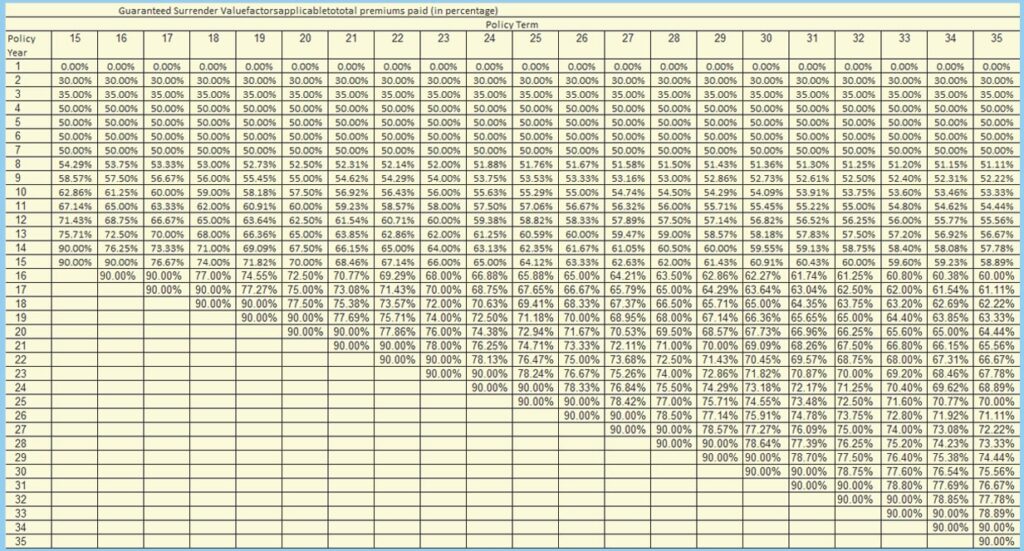

The Guaranteed Surrender value can be calculated as the total premiums paid (excluding extra premiums, taxes, and premiums for riders, if opted for) multiplied by the Guaranteed Surrender Value factors applicable to total premiums paid.

The following are the Guaranteed Surrender Value factors percentages which depend on policy term and policy year in which the policy is surrendered-

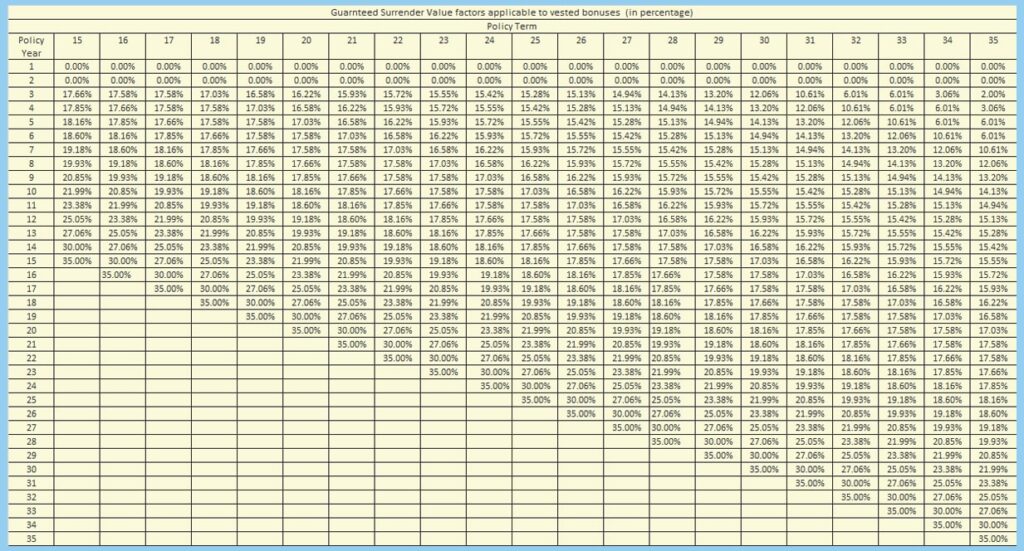

In addition, the surrender value of any vested simple reversionary bonuses, if any, shall also be payable, which is equal to vested bonuses multiplied by the Guaranteed Surrender Value factor applicable to vested bonuses. These factors will depend on the policy term and policy year in which the policy is surrendered and are specified below:

Exclusion

The policy will become void if the policyholder commits suicide. If the policyholder commits suicide with 12 months from the date of commencement of risk, the corporation will not entertain any claim. Only 80% of the total premiums paid will be provided to the nominee of the policyholder, provided the policy is in force.

If the policyholder commits suicide with 12 months from the date of revival, 80% of the total premium paid till the death or surrender value whichever is higher will be payable by the corporation.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.