The United Arab Emirates or UAE is a middle eastern country with a population of 9.9 million residents. UAE and India enjoy great diplomatic and economic benefits that help both countries to trade and engage in development.

There are a lot of bilateral agreements and partnership programs that both countries engage in. Also, UAE has one of the largest Indian diasporas i.e., 38% of the entire UAE’s expats are Indian.

With such a close economic tie, the Indian Government has decided to expand UPI’s network to some foreign countries including the United Arab Emirates.

Now, you’ll be able to use the UPI in UAE for the sales and purchase of Goods and Services. India’s UPI success story is world renounced and with the expansion of the UPI into foreign countries, the digital clout of UPI will further grow.

In this article, we will discuss how to use UPI in the United Arab Emirates for the purchase of Goods and Services.

But first, let’s talk about the benefits of using UPI.

Table of Contents

Benefits of UPI

The following are the benefits of UPI-

- It is free to use i.e., no middleman service charge is deducted

- It is a real-time payments network that transfers funds instantly without any delay

- You can pay for goods and services using the UPI

- UPI is an advanced technology that uses mobile phone apps to transfer funds

- UPI is widely accepted in India and now across the world with other countries joining the digital revolution headed by India

- UPI can be used without the need for the internet using USSD codes which makes it usable with feature phones as well

How to Use UPI in the United Arab Emirates?

You can follow these steps to use UPI in the United Arab Emirates-

- Download and install the BHIM UPI app on your Smartphone and Open the app

- You’ll have to link your UPI app with your bank account if already linked then you can proceed further to enable the UPI app for global usage

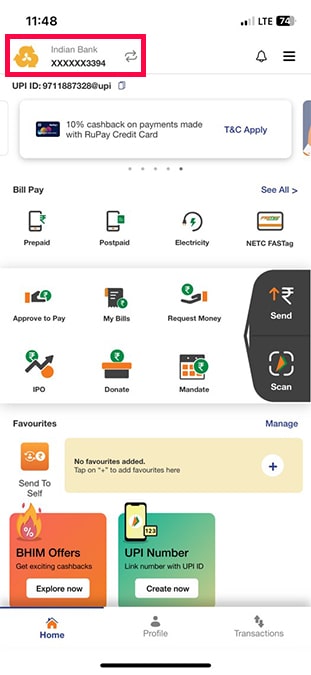

- Now, click on the upper-left corner of the screen with the bank logo

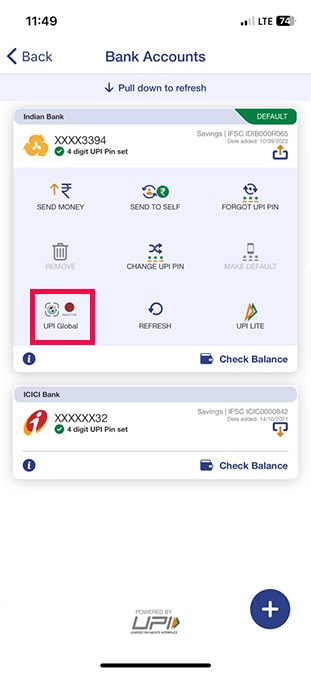

- You’ll be redirected to a tab where you’ll find the listed banks which are using the UPI app

- Now, click on the bank which you want to use for the transaction and you’ll see various options listed

- There you’ll find the UPI Global setting which you’ll have to click

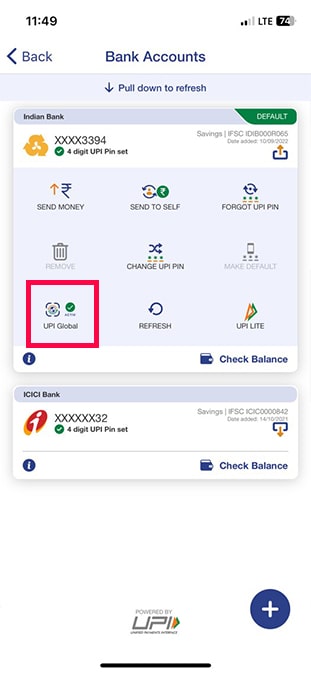

- Now, you’ll have to click on the submit button followed by entering the UPI MPIN

- After entering the correct UPI, your UPI global payments will be enabled and you’ll be able to make transactions easily in the United Arab Emirates

FAQ

Yes, with UPI 2.0, UPI has gone global and you’ll be able to make payments using UPI in other countries as well. The list of countries where you can make UPI payments is UAE, Nepal, Bhutan, France (in Advanced Stages), Saudi Arabia, Singapore, etc.

No, UPI payments all over the globe are free. Since you are paying Indian rupees in another country’s currency, therefore, you have to take the exchange rate of that country against the Indian rupee into the calculation, and also currency conversion fee will also be lived on your transactions.

Yes, the exchange rate affects your transaction if you are using UPI Global while making payments because you are converting the Indian currency to foreign currency and then making payments using that.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.