Prime Minister Shri Narender Modi recently launched an online portal for retail investors to buy and sell Government bonds and securities.

This portal was launched to facilitate the retail investor by offering easy access to investors via online means. Earlier, a Government-issued bond was bought by filing a request for the purchase of Government Bonds.

Earlier, the investment into Government bonds was channelized indirectly via schemes like NPS, Mutual Funds, and other investment options, but, with the launch of this portal, retail investments have become easy and accessible to every individual.

In this article, we will discuss how to register for RBI Retail Direct Scheme documents required, the application process, etc.

But first, let’s find out what is RBI Retail Direct scheme is.

Table of Contents

What is RBI Retail Direct Scheme?

RBI Retail Direct Scheme allows a retail investor to buy and sell Government securities in both primary and secondary markets.

It is a game-changer move by the government allowing small investors to invest in Government securities using gilt securities account with the RBI called Retail Direct Gilt (RDG) Account.

RBI authorized CCIL to act as an aggregator for Primary Issuances and as Receiving Office for Sovereign Gold Bonds for Retail Direct Investors and to operate the NDS OM platform as well.

Documents Required for Application Process

The following are the documents required for the application process-

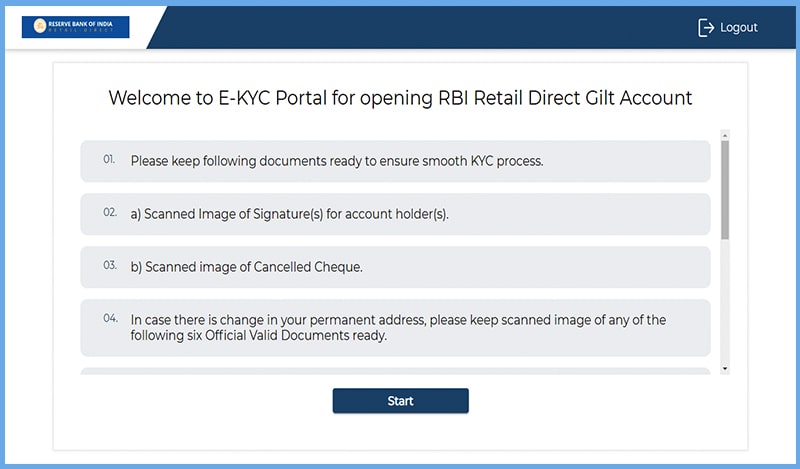

- Scanned Signature in JPG or PDF Format

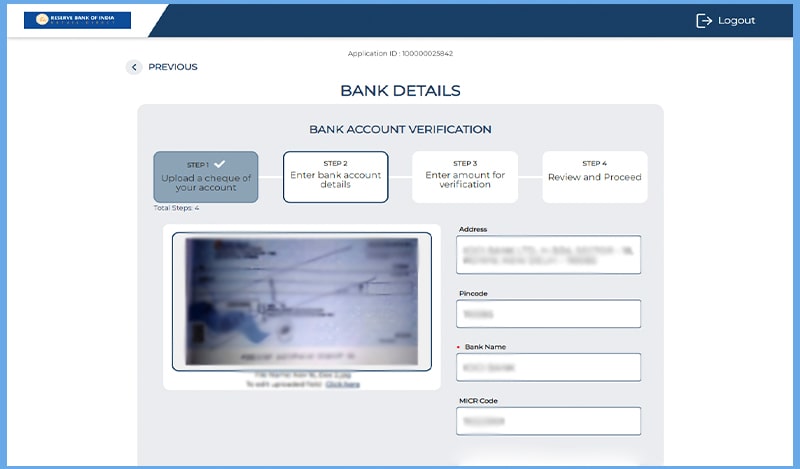

- Scanned Cancelled Cheque book of your bank account in JPG or PDF format

- PAN Card Number

- Aadhaar Card Number for eKYC

- Email Id

- Mobile Number connected to your PAN, Aadhaar and Bank Account

Note- You must have your mobile number connected to your PAN Card, Aadhaar Card, and your Bank Account to smoothly process your application

How to Apply for RBI Retail Direct Scheme?

The following are the step by step instructions on applying for the RBI Retail Direct scheme-

- Visit the official website of RBI Retail Direct by following this link- https://www.rbiretaildirect.org.in/

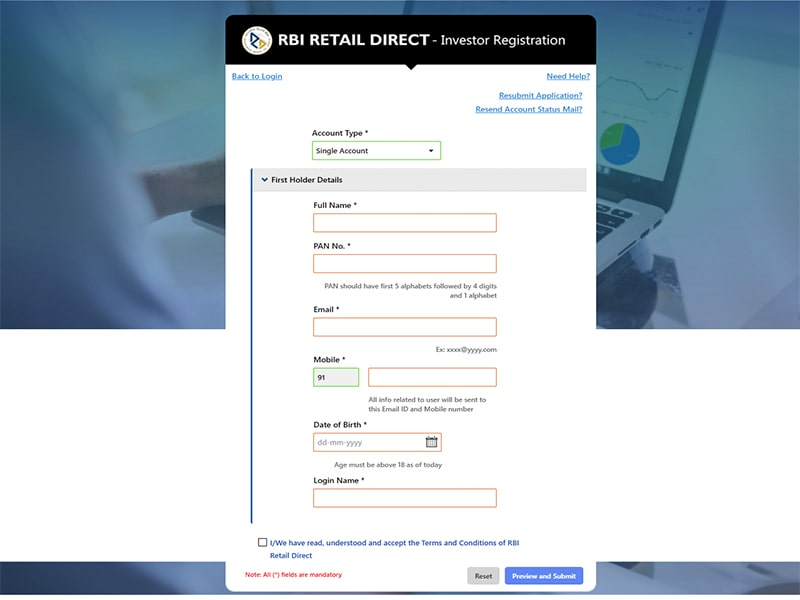

- Now, click on the Open RBI Direct Account followed by filling the first form with correct details. Here, you have to provide account type, name, mobile number, email ID, PAN Card number, etc.

- You have to verify your email Id and Mobile number using OTP send on them followed by clicking on the preview and submit button

- Now, preview the application and click on the submit button

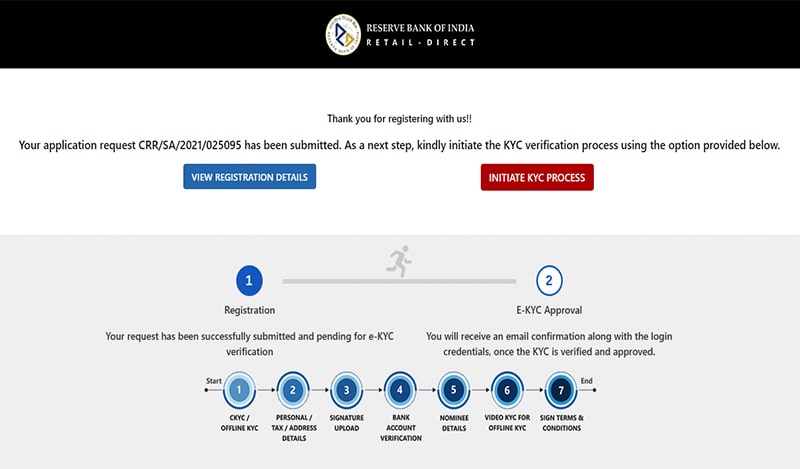

- After submitting, you have to initiate your KYC process by clicking on the “Initiate KYC” button

- Now, a welcome screen will be displayed where you have to click on the start button but, before that make sure you have all the documents ready which are mentioned above

- Now, most of the details will be auto-populated which will be initiated using your Aadhaar Card and PAN card. However, you must have your Aadhaar and PAN linked

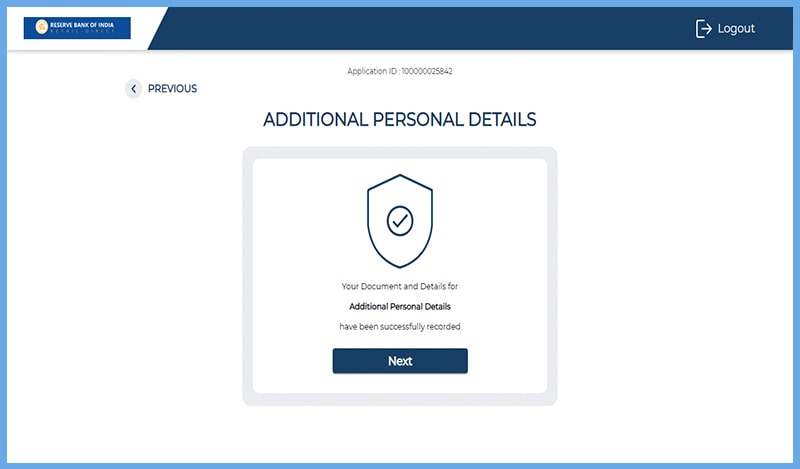

- You have to click on the next button by reviewing them at each step

- After reviewing details, click on the submit button after PMLA and FATCA Declaration

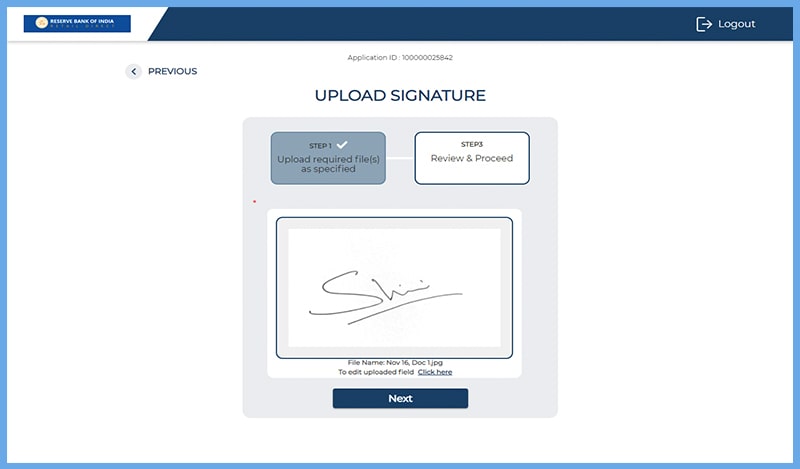

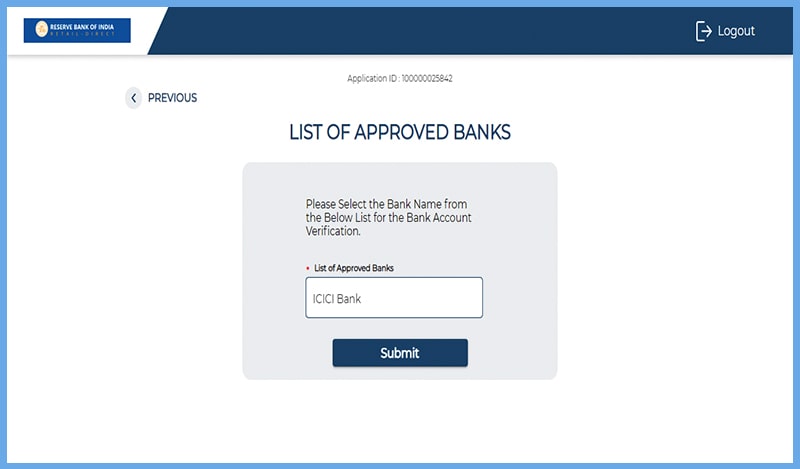

- Now, you have to upload the signature, and your bank canceled the cheque

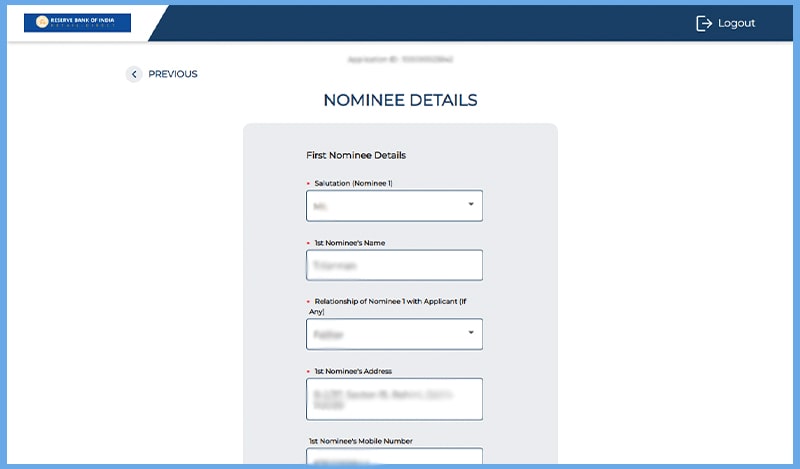

- After the upload is complete, you have to fill in the nominee details by filling in the name, relationship, bank account number, IFSC Code, and branch detail

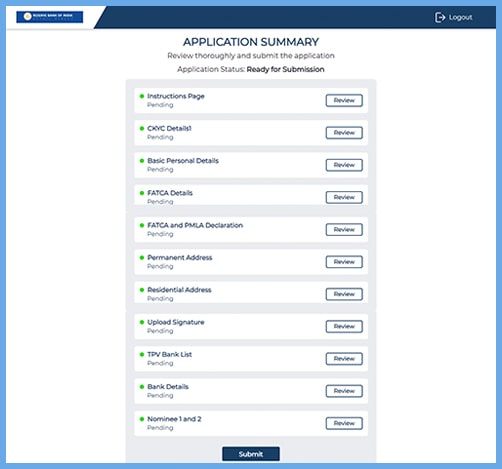

- Now, you’ll be prompted with an application summary followed by clicking on the Submit button

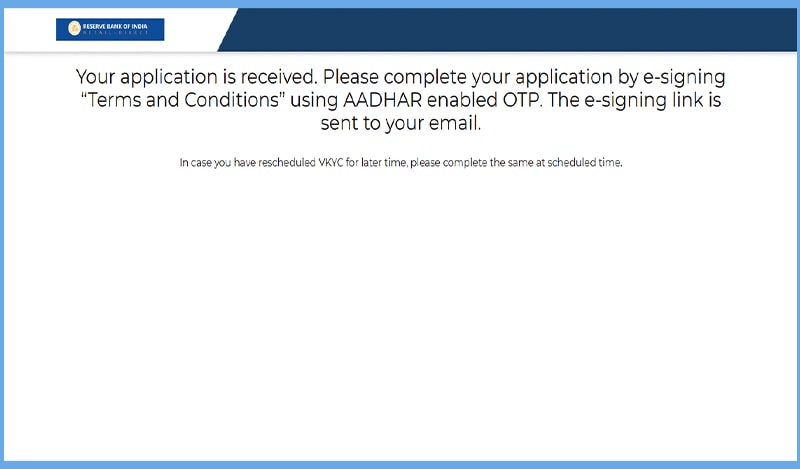

- Your application is successfully submitted, you just have to e-sign the documents sent on your Email ID to complete the registration process

- Now, open your email and click on the e-sign button sent on your email by the RBI Retail Direct portal

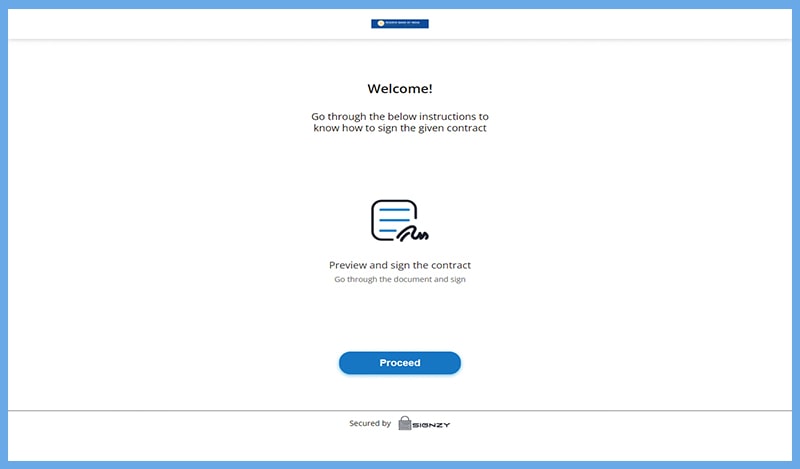

- Now, you have to preview and sign the contract for which you have to click on the proceed button

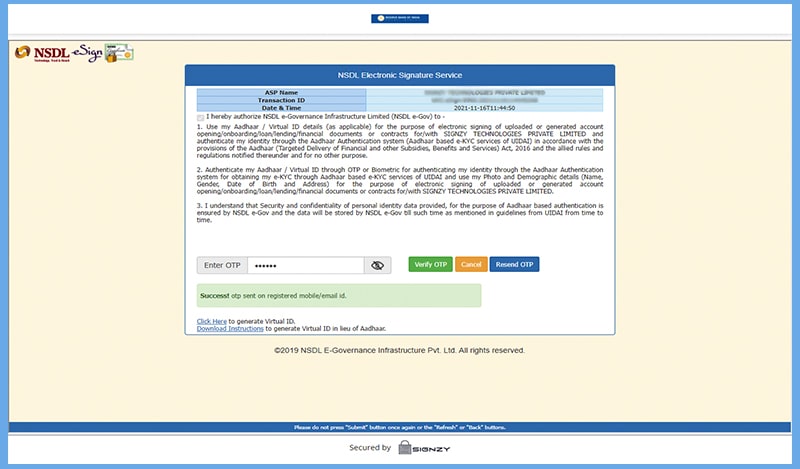

- A CDSL/NSDL e-sign portal will open here, you have to enter your Aadhaar card number and click on send OTP button

- Now, an OTP will be sent on your registered mobile number which you have to enter followed by clicking on the verify OTP button

- You’ve successfully signed the documents and three files will be sent via email which is your account related document

- The login details of your account will be sent on your email only after the verification of the documents is done, usually, it takes around 1-2 business days

FAQ on RBI Direct Scheme

Any Individual above the age of 18 can invest in RBI Direct schemes, however, the individual must have a rupee savings account, PAN card followed by other documents mentioned above.

Retail investors have a facility to open and maintain a ‘Retail Direct Gilt Account’ (RDG Account) with RBI where you can sell and purchase various Government-issued securities.

Under this scheme, the individual can also access the Secondary market through “NDS OM” – RBI’s trading system.

The investor will automatically receive any interest paid/maturity proceeds into his linked bank account on due dates.

You can pay for Government bonds by using your UPI, or Net banking portal

Is there any charges/fee associated with the account opening or maintenance?

No, there are no fees for account opening or maintenance charged. You can open an RBI Direct Scheme account or RBI Gilit account for free.

Yes, you can get help and support facilities on the portal itself or you can use a toll-free number 1800–267-7955 (10 am to 7 pm). You can also use an email Id to contact the RBI Retails Direct scheme by sending an email to support@rbiretaildirect.org.in.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.