Banking is a basic need of an individual to keep his/her money safe and secure. From your salary to business operations, everything is managed using a bank account.

To aid the expanding demand of the banking system among the netizens, Punjab National Bank has provided an online banking facility which you can use from the comfort of your home.

Now, you can open a PNB bank account from your home but, you still have to visit the bank branch at least one time to physically verify your KYC.

It’s for security reasons but never the less it saves you from the hassle of visiting the bank branch back and forth to opening a bank account.

In the below column, you’ll get step by step method on how to open a PNB Bank account online but first, let’s check the eligibility criteria for opening a bank account online.

Table of Contents

Eligibility Criteria to Open PNB Bank Account

To open a bank account, you have to meet certain eligibility criteria set by the bank under the guidelines of the Reserve Bank of India, which is as follows-

- You have to produce relevant Government approved documents to open a bank account

- As such, there are no restrictions on who can open a bank account but, the person has to choose the type of account to open like for example- Foreigners can only open an NRO account, for children below 18 years of age can only open a PNB minor account, etc.

- For a non-zero balance account, you have to make an initial deposit to the bank account and maintain the Average Monthly Balance requirement of the bank.

Documents Required to Open a Bank Account

The following are the documents required to open a Bank Account-

ID Proof

- PAN card

- Aadhaar card

- Voter ID

- Passport

- Driving license

- Employee ID

- Any photo ID card issued by the Central/State government

Address Proof

- Voter ID

- Utility bill (electricity, gas, water, telephone)

- Passport

- Driving license

- Bank account statement or passbook of the bank

- Ration card

- Aadhaar card

Other Documents

- Passport Size Photograph

How to Open PNB Bank Account Online?

Now, after collecting the documents required for account opening, you have to follow these steps to open a bank account online-

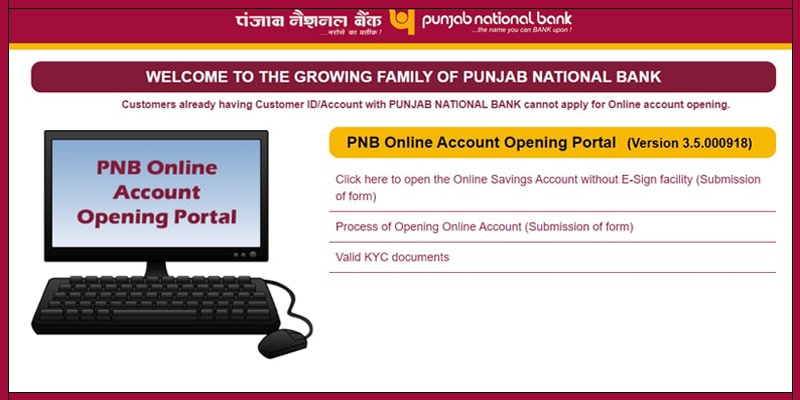

- Visit the official website of the PNB Online Account opening portal and click on the ‘Click here to open the Online Savings Account without E-Sign facility (Submission of the form)’ button

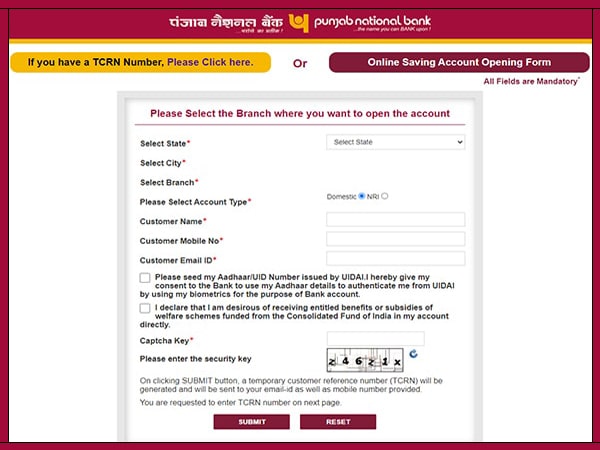

- Now, you’ll be redirected towards a form which you have to fill

- Provide your state, city, and branch followed by selecting the account type and providing the name, email, and phone number

- Tick the checkboxes, fill the captcha and click on the submit button to initiate the form filling

- Now, a form will appear where you have to provide further detail like your full name, address, Aadhaar Card number, PAN number, etc.

- After filling the form, click on the Next button

- Now, on this page, you have to provide the details of the document that you want to use for KYC

- After providing your documents details, click on the submit button

- Your form is submitted, now, you have to visit the bank branch that you have selected and mention the TRN number that you have received on your mobile number

- While visiting the bank branch, make sure you have a photocopy as well as original KYC documents along with you.

- After evaluating your application form and verifying your KYC, you will be notified about your account opening status

- You’ll receive a PNB Account starter kit that includes a debit card, credit card (if applied), passbook, cheque book, etc.

If you find any issue or difficulty in filling the form or have a complaint then you can contact on PNB customer care toll-free number – 1800 180 2222

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.