Sir Sorabji Pochkhanawala founded the Central Bank of India out of a sense of nationalism in the year 1911 and proclaimed it as the property of the nation and the country’s asset’. This first really ‘swadeshi’ bank has implemented numerous unique banking techniques to promote not only medium and large industries, but also help the Indian agriculture and small-scale industries. The Central Bank of India supports employment by introducing several Self Employment Schemes for employment amongst the educated youth.

The bank issues debit card to all its customers for easy money withdrawals. There are different debit cards for different purchasing needs. Shopping cum Debit Card allows easy money withdrawals from the ATM machines, along with features of cashless purchases with attractive buying offers. The Wonder Debit Card is used by Salaried Savings Account Holders. It is a single window for overdraft accounts and operating saving. The card holder can use this debit card to make purchases even with no balance. RuPay debit card is meant for use in India only. Platinum debit card is meant for HNI customers and have high withdrawal and shopping transaction limits. N+eXGen debit cards are meant for miners. And, lastly, Platinum RuPay debit card is meant for domestic and international acceptance. Anytime a customer wants to block a card, then he or she could do so through numerous ways. Continue reading the article to know all the ways by which you can block your debit card.

Table of Contents

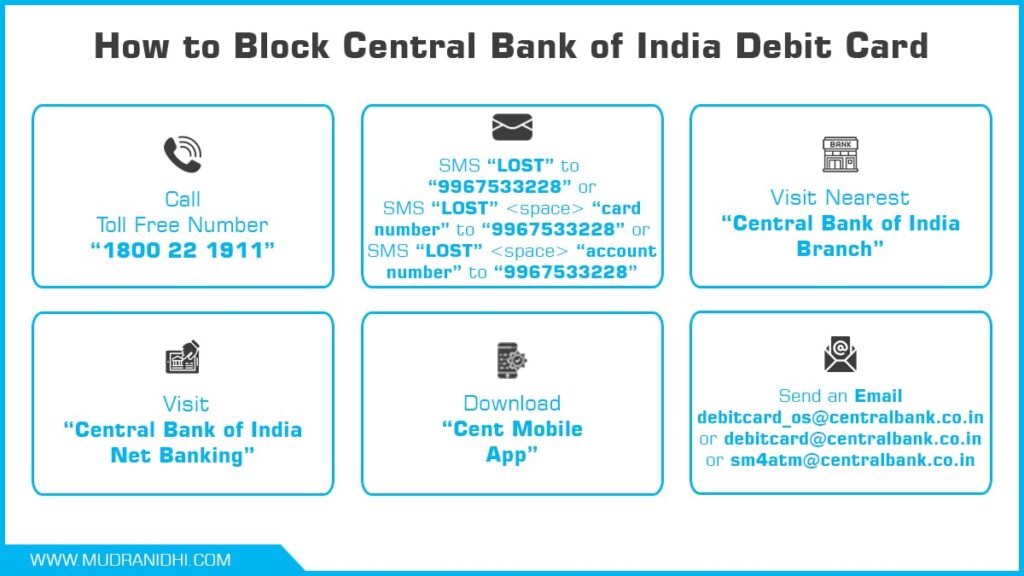

Block Central Bank of India Debit Card through Toll Free Number

The Central Bank of India has initiated a number of toll-free numbers to help its customers. These numbers are free of cost and can be dialled any time of the day, including holidays, to get customer-centric services. In case, you have lost your debit card and wants to block it, then you can easily do so by calling on the toll-free number 1800 22 1911.

Block Central Bank of India Debit Card through SMS Facility

SMS facility is the modern tool of communication and can be used for a number of purposes, including the request for blocking of your defective or lost debit card. You need to send the card block request in a specific format to 9967533228 from your registered mobile number to get the desired result.

- To block all cards associated with a particular mobile number,

SMS LOST to 9967533228

Example: LOST

- To block a specific card number associated with a particular mobile number,

SMS LOST <space> card number to 9967533228

Example: LOST 5044370011112332

- To block a debit card in a particular account,

SMS LOST <space> account number to 9967533228

Example: LOST 3333344554

Once a card has been successfully blocked, the account holder will receive an affirmative notification on the registered mobile number. In the instance of a problem (unregistered mobile number, faulty account number, etc.), a suitable message would be sent to the requestee.

Block Central Bank of India Debit Card through email

You can also email your queries to the bank regarding debit card hot listing, although this process may be time consuming and you may have to wait to get the desired results. The email ids for communication are debitcard_os@centralbank.co.in, debitcard@centralbank.co.in, and sm4atm@centralbank.co.in.

Block Central Bank of India Debit Card through Net Banking

You can also block the Central Bank of India debit card through the net banking facility.

- Visit the official website of Central Bank of India.

- Go to the cards section.

- Select the option ‘Block Debit Card’.

- Choose the account number whose debit card needs to be blocked.

- You will get a notification that your card has been blocked.

Block Central Bank of India Debit Card through Cent Mobile App

Download the Cent Mobile App in your registered mobile number. Log into the Cent Mobile App and search for the option- ‘Request for ATM (Debit Card) Blocking’. Use the option to instantly block the card.

Block Central Bank of India Debit Card through Local Branch Visit

In case, you are not comfortable with any of the above options, then you can also visit the local branch to get your debit card blocked. Here you would need to fill in a form to block or hotlist your ATM cum debit card. The card would be blocked at the earliest. You can also fill in a request for new issuance of ATM cum debit card to continue with smooth transactions.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.