Public Provident Fund or PPF Account is a government-backed scheme that provides attractive interest rates for long-term investment.

The maturity period of this investment is 60 years of age i.e. retirement age which can be extended further to 70 years. You can start this account after 18 years on your own and with your parent before 18 and contribute till your retirement age.

On maturity, you’ll receive the pension amount monthly, quarterly or yearly. You can open the PPF Account using your Indian Bank Account.

In this article, we will discuss how to apply for a PPF account in the Indian bank? documents required, benefits, the application process, etc.

Table of Contents

Eligibility Criteria for PPF Account

The following are the eligibility criteria for PPF Account in Indian Bank-

- The applicant must be a citizen of India

- HUF is not allowed to make contributions to the PPF Account

- For minor accounts, the parents or guardian must imitate the account opening process under his/her guidance

- NRI can also contribute to the PPF Account if they had PPF Account before becoming NRI.

Benefits of PPF Account Opening

The following are the benefits of PPF Account-

- You can invest in PPF Account as low as Rs.500/- per annum to 1.5 lakhs per annum in both lump sum or in installments

- PPF Account is an Exempt-Exempt-Exempt scheme which means the tax on principle, maturity, and interest earned amount is exempted under the Income Tax Act

- PPF Account has a lock-in period of 15 years however, you also have premature withdrawal and you can also avail loan against your PPF Account

- This scheme is backed by Government and offers very attractive interest rates

Documents Required for PPF Account Opening

The following are the Documents Required for PPF Account-

- Passport

- Driving license

- Voter’s ID card

- PAN card

- Job card issued by NREGA signed by the State Government officer

- Letter issued by the National Population Register containing details of name and address)

For minor PPF accounts, the following are the documents required-

- Proof of Date of Birth i.e. Birth Certificate of the Minor

- Details of Guardian (Natural/Legal) along with KYC documents

Indian Bank Interest Rate on PPF Account

The latest rate provided under the PPF scheme is 7.1% as of 2022. The following are the historical interest rate of Bank PPF Account-

| Year | Rate of Interest |

| From 1 April 2020 to 31 March 2022 | 7.1% |

| From 1 July 2019 to 31 March 2020 | 7.9% |

| From 1 October 2018 to 30 June 2019 | 8.0% |

| From 1 January 2018 to 31 September 2018 | 7.6% |

| From 1 July 2017 to 31 December 2017 | 7.8% |

| From 1 April 2017 to 30 June 2017 | 7.9% |

| From 1 October 2016 to 31 March 2017 | 8.0% |

| From 1 April 2016 to 30 September 2016 | 8.1% |

| From 1 April 2013 to 31 March 2016 | 8.7% |

| From 1 April 2012 to 31 March 2013 | 8.8% |

| From 1 December 2011 to 31 March 2012 | 8.6% |

| From 1 March 2003 to 30 November 2011 | 8% |

| From 1 March 2002 to 28 February 2003 | 9% |

| From 1 March 2001 to 28 February 2002 | 9.5% |

| From 15 January 2000 to 28 February 2001 | 11% |

| From 1 April 1999 to 14 January 2000 | 12% |

| From 1 April 1986 to 31 March 1999 | 12% |

How to Open a PPF Account in Indian Bank?

You can open a PPF Account in both online and offline means. The following are the step by step instructions-

Note-For online account opening you do not need to submit any documents as your bank has your documents already, they can make use of them. However, you do require the documents if you are opening a PPF Account offline.

Online

Indian Bank Net Banking

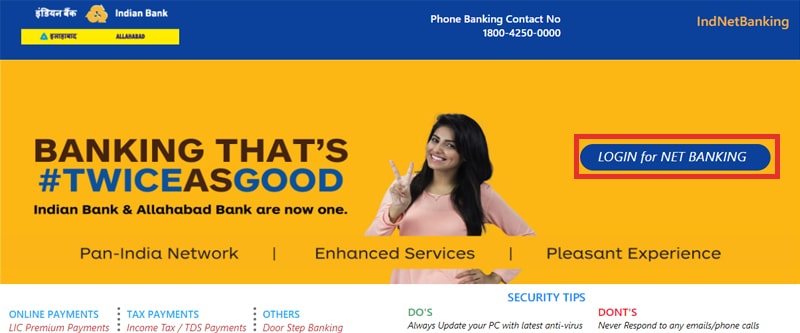

- Visit the Indian Bank Net Banking portal

Visit the official net banking portal of Indian Bank and click on the login button

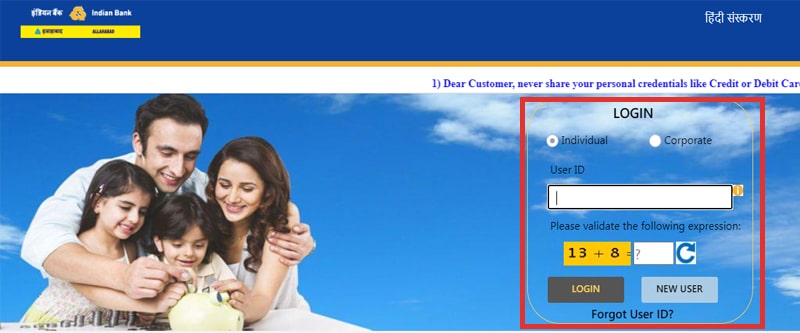

- Login to your account

Now, login to your account using your login credentials

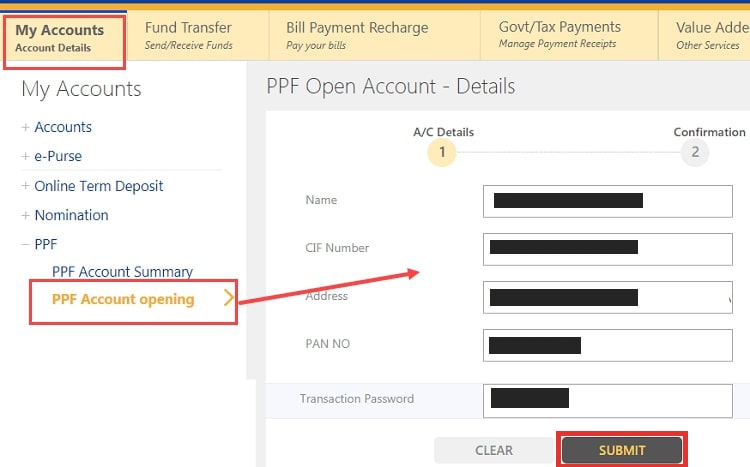

- Click on the Account details followed by PPF Account

After logging in, navigate to the Account details tab followed by clicking on the PPF Account Opening button

- Fill the form

Now, a small form will appear which you’ll have to fill with details like name, CIF number, PAN number, etc.

- Enter Transaction Password

After populating the form, you’ll have to enter the Transaction Password followed by clicking on the Submit button

- Confirm your application request

After clicking on the submit button, you’ll have to confirm your account and enter the amount you want to deposit as the first deposit using net banking

- PPF Account Successfully opened

Your account is successfully opened and you can now deposit PPF account funds using your Indian Bank Account

IndOASIS Bank App

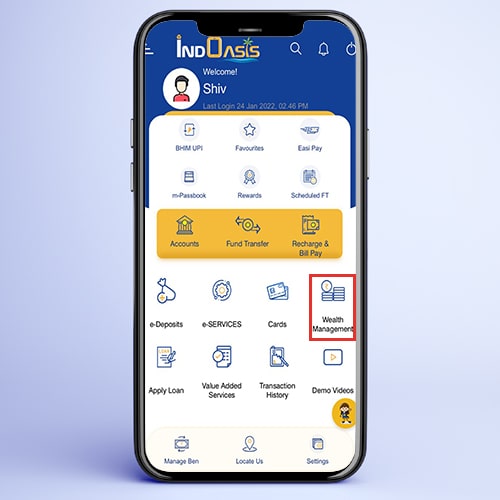

- Open your IndOASIS app on your smartphone using your login credentials

- After logging in, you’ll have to click on the Wealth Management tab preset on your dashboard

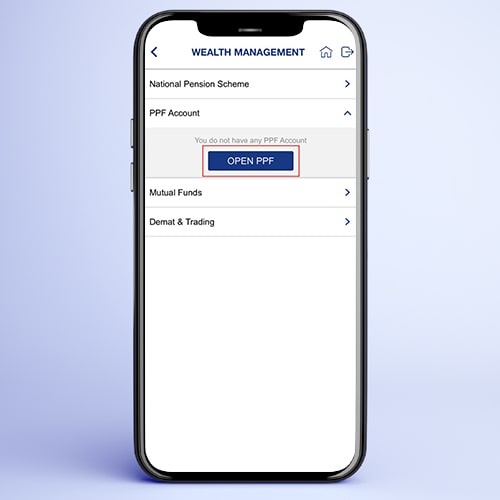

- Click on the Open PPF Account button under the PPF account tab

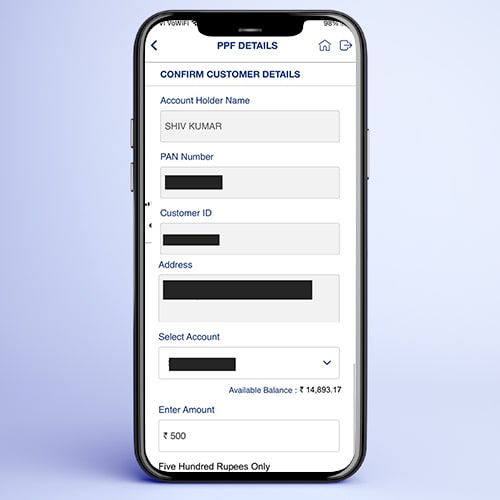

Now, a partially filled form will appear which you’ll have to complete with correct details followed by clicking on the submit button

- After clicking on the submit button, you’ll have to enter the MPIN followed by the OTP sent on your registered mobile number

- Now, your PPF Account has been created and you can continue to contribute to the PPF Account as per your requirement

Offline

For offline account opening, visit the Bank branch where you have your Indian bank account. Now, Ask the bank Bank representative for the PPF Account opening form and fill the form with the correct details.

Now, submit the form along with the documents mentioned above also make sure to attach the cheque or cash as the initial deposit amount.

After reviewing your application, your account will be opened and you’ll receive an SMS with your PPF Account details.

FAQ

No, You can only open one account, More than one account will not be allowed by the bank, also, you cannot open another PPF account with other banks.

Yes, you’ll be penalized if you do not make payment in time. The minimum amount you are required to contribute towards the account is Rs.500/- per annum. If you do not pay this amount each year then you’ll be penalized Rs.50/- per year.

After becoming NRI, you can continue to pay for PPF Account given you have opened your PPF Account while being an Indian resident.

Yes, you can avail loan against your PPF Account.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.