The Income Tax Department recently launched a new initiative to offer ePAN cards to Indian residents for no charges. You can get an ePAN card free of cost and the best part about it is that you do not need a lot of documents. You’ll only need an Aadhaar card to apply for an E PAN card. This article is all about How to Apply for E PAN Card and get an instant PAN card without documents.

Table of Contents

Eligibility for E PAN

The following are the eligibility criteria for E PAN Card-

- The applicant cannot apply for an ePAN card if the applicant holds a PAN Card before. No duplication of PAN Card is allowed as per the Income Tax Act. If you hold two PAN cards then it can be a punishable offense therefore, you have to surrender your Duplicate PAN Cards.

- ePAN Card can only be obtained by an individual and it cannot be obtained by Hindu Undivided Families, firms, trusts, companies, etc. for these entities, the applicant must apply for the PAN card the traditional way.

- Aadhaar card is mandatory for the candidate who wants to apply for the ePAN card.

- The applicant must have linked Aadhaar card with their mobile number as these two requirements are necessary for the ePAN card application

How to Apply for E PAN Card?

The following are the step by step methods on How to Apply for E PAN Card –

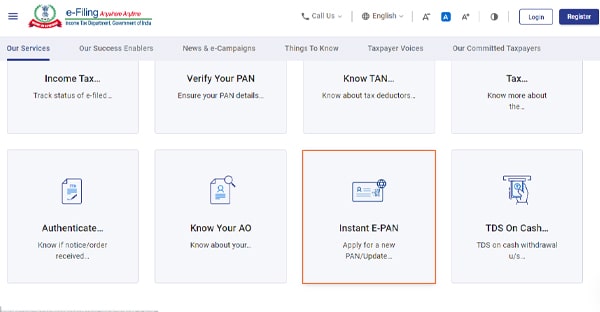

- Visit the official website of the Income Tax filling by following this link-https://www.incometax.gov.in/

- Now navigate to the instant PAN card apply tab and click on the tab

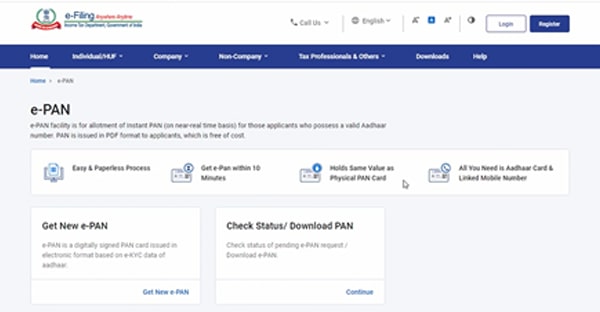

- A new window appears, here click on the new ePAN card apply button

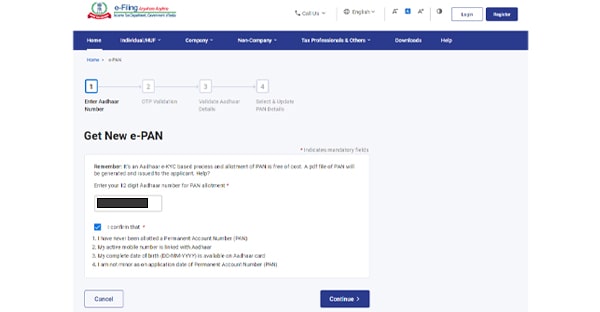

- You’ll be redirected to a new page where you have to enter your 12 digit Aadhaar card number followed by clicking on I confirm button

- Make sure you have read all the four disclaimers mentioned below and ensure you satisfy all of them

- Now, click on the continue button

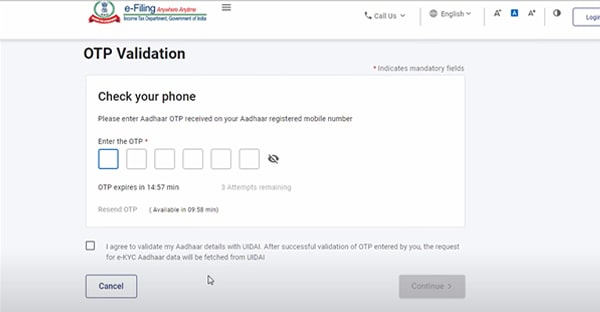

- A new OTP to your registered mobile number mentioned on your Aadhaar card will be sent

- Enter the OTP on the given space and press the continue button

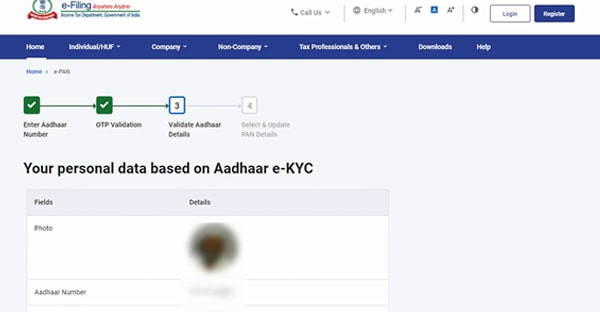

- After pressing the Continue button, you have to validate your Aadhaar details followed by clicking on the I accept button and further press the continue button

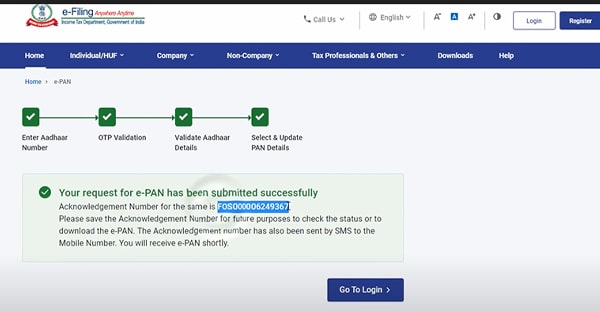

- Now, you’ll be prompted with your ePAN card application submitted successfully

- You have to save the acknowledgment number for future use.

- TO download the ePAN card, the applicant should check the status of the ePAN card application.

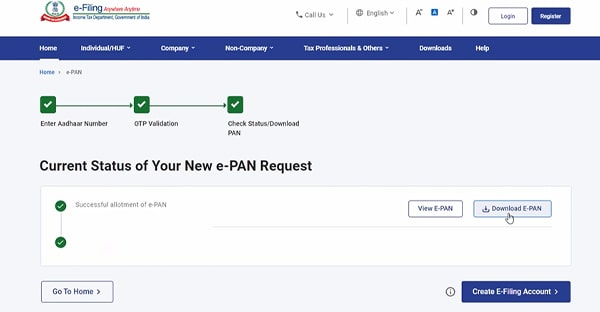

Check E PAN Card Apply Status

The following are the steps to check the status of your ePAN Card application-

- Visit the official website of the Income Tax portal

- Navigate to the Instant PAN apply tab

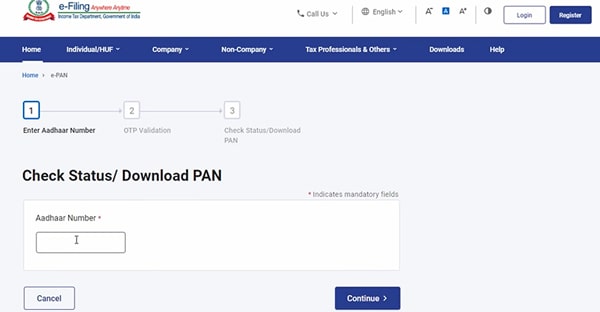

- Now, a new window with check status/Download ePAN Card button comes, you have to choose this option

- Now, you’ll be redirected to a new page where the applicant has to insert their Aadhaar card number

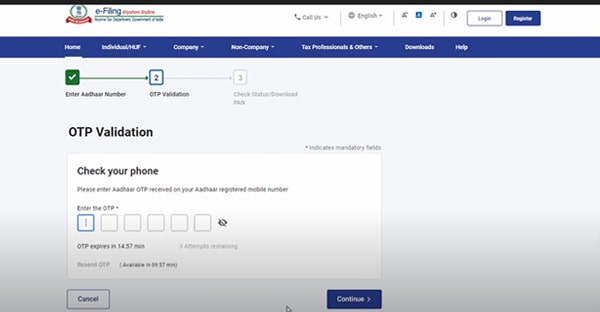

- Now an OTP will be sent to your registered mobile number which you have fill in the given application

- After inserting the OTP, the status of your PAN card will be displayed.

- If your PAN card is not yet created then you have to check for back again

- If the screen shows your PAN is ready then you can download the pan card by clicking the Download PAN card button

- After downloading your ePAN card, you’ll need a password to open the file.

- The password for PAN card download is your date of birth for example- if your birthday is on the 12th of October 2000, then the password would be 12092000 .

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.