IDFC First Bank is one of the youngest Indian private sector banks established in 2015. The bank offers Savings/Current Accounts, Deposit Schemes, Insurance, Loans, Investment Schemes, Forex Services, and much more. IDFC First Bank earlier known as IDFC Bank merged with Capital First in December 2018 and renamed IDFC First Bank.

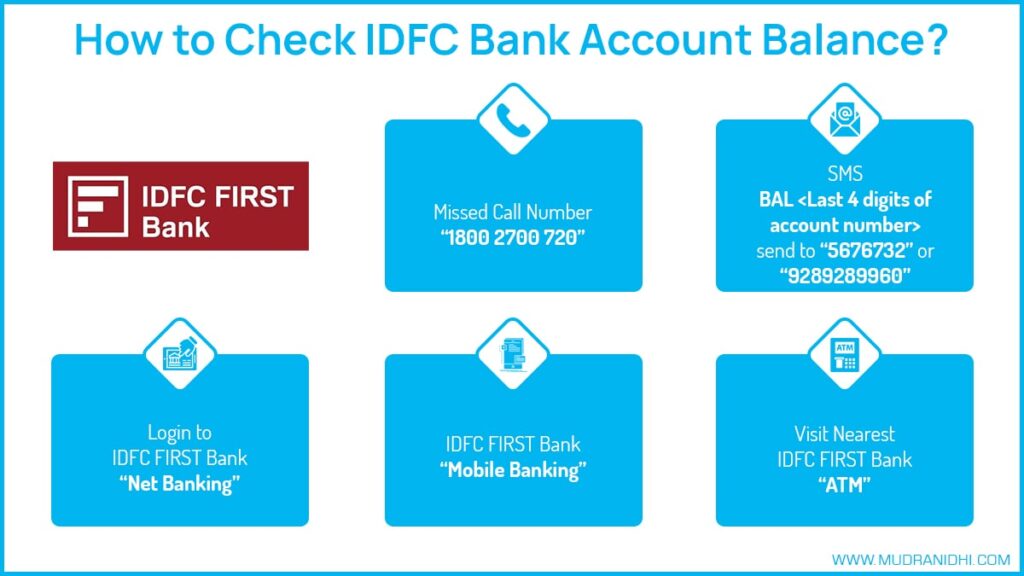

The bank has a large customer base with a network of branches in all the states in India. If you have a bank account in IDFC First Bank and need to know account balance, you can try one of the many ways the bank offers to check your IDFC First Bank account balance.

Table of Contents

IDFC First Bank Balance Inquiry Missed Call Number

IDFC First Bank provides a missed call banking facility that enables the account holder to check the bank account balance by giving a missed call. The IDFC First Bank Toll Free Missed Call Number is 1800 2700 720. If called this IDFC First Bank missed call number from a registered mobile number, you shall receive a text message containing the bank account details.

IDFC First Bank SMS Banking via IDFC First SMS Balance Check Number

SMS Banking is another way that is used to find the bank account balance. You need to send the SMS to the IDFC First Bank SMS Banking number-5676732 or 9289289960 in a predefined syntax.

The following are the syntax used to find the respective services-

Type BAL <Last 4 digits of account number> and send at 5676732 or 9289289960.

You can also get a mini statement with last 5 transaction details at your mobile through SMS.

Type TXN <Last 4 digits of account number> and send at 5676732 or 9289289960.

Check Balance by IDFC First Bank Mobile Banking

IDFC First Bank provides a mobile banking app that enables the account holder to use the mobile app to access the banking features like fund transfer, balance check and much more. The download link for IDF CFirst Bank Mobile app is as follows-

- Download for Android

- Download for iOS

Check Balance by IDFC First Bank Net Banking

Net Banking is a banking service that is convenient to use as it enables the account holder to access the banking service 24X7 and 365 days without requiring visiting the bank branch. To use the service the account holder needs the login at my.idfcbank.com/start with the user name and password provided by the bank.

Check Balance by IDFC First Bank ATM

If you have an IDFC Bank ATM card, you can use the IDFC First Bank ATM to check the account balance quickly. It is free to use service for IDFC First customers. Check the Bank account balance by using the following steps-

- Insert the ATM Card in the ATM Machine

- Enter your 4-Digit PIN in the ATM Machine

- Now select the Balance Inquiry option

Minimum Maintenance Balance for IDFC First Bank

Every bank keeps a minimum balance requirement that has to be maintained by the account holder. If the account holder fails to maintain the account then the account will be charged with non-maintenance charges.

Average Account Maintenance

| Type of Account | Average Monthly Maintenance Balance |

|---|---|

| Personal Savings Account | 25,000 |

| Regular Business Account | 10,000 |

| Regular Business Account-II | 1,00,000 |

| IDFC Shakti | 100 |

| IDFC Param | 1000 |

| IDFC Vishesh | 5000 |

Non-Maintenance Charges

| Type of Account | Condition | Non-Maintenance Balance |

|---|---|---|

| Personal Savings Account | NA | Charged to keep the account operational |

| Regular Business Account | NA | 300 |

| Regular Business Account-II | NA | 500 |

| IDFC Shakti | NA | 20 |

| IDFC Param |

Rs.

500 to less than Rs. 1000 less than Rs. 500 |

100 200 |

| IDFC Vishesh |

Rs.

2500/- to less than Rs. 5000 Less than Rs. 2500 |

300 500 |

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.