Google AdSense is a great way to earn a passive income stream which can help you earn some extra bucks per month.

The penetration of the internet deep into Indian Society helped various individuals to earn income through various sources like AdSense.

When we talk about income how can we forget the taxes and GST on the service? It is extremely important for the service provider i.e., Digital Creator to have adequate compliance to register his income with the Tax Authorities.

In this article, we will discuss how to file GST for AdSense Income, factors that effects GST, whether Digital Creators shall apply for GST, etc.

Table of Contents

Sources of Income for a Digital Creator

Before, moving further we should first evaluate the various income stream that a Digital Creator has. The following are the sources of income that a Digital Creator has-

Google AdSense

Google AdSense is one of the primary sources of income for a digital creator especially if he/she is a YouTuber or blogger.

You allow Google to place ads in between the content that you’ve created and the digital creator will earn money whenever someone clicks on the ads or impression bases.

Affiliate Marketing

Another source of income for Digital Creators is Affiliate Marketing. The concept is simple, if you can sell an item to your audience then the selling company will pay some amount of commission for the sale.

The income earned through this method is considered affiliate sales income i.e., commission income.

Sponsor Ads

Sponsor Ads are basically, a company asking the digital creator to create content catered specifically for the product they are selling and paying the digital creator on per content basis.

In this process, the digital creator also gets free products but that should not be considered as income or revenue.

Factors that Effects GST

GST is Goods and Services Tax which is the tax imposed on the sale of Goods and Services. The digital creator creates a video which is a type of service itself.

Hence, GST on Digital Creator is applicable as GST on services. But there are other factors as well that will affect the GST, which are as follows-

Place of Supply

The place of supply i.e., the origination for the services are considered for applying GST. In the case of Google AdSense, the place of supply is Google Asia Pacific, Singapore hence, the location of the place of supply is outside the geographical boundaries of India. Since it is outside India there is no GST to be charged for this service.

Nature of the Service

The nature of the service is another factor that goes into the calculation of the GST. Digital Content creators provide their services using the Internet by creating content and generating income via ads and other means. Hence, the digital creator provides a taxable service to Google AdSense.

But, since, the location of the place of supply is outside India therefore, no GST can be levied upon Google AdSense. This is due to the technicality and the constitution of the rules of the GST.

Is this service Considered an Export?

According to Sec 2(6) of the IGST Act, an export of the service means-

- The supplier of the service is located in India

- The recipient of the service is located outside of India

- The place of supply of service is outside of India

- The payment of the service is received in convertible foreign currency i.e., other than Indian Rupee

- The supplier, as well as the recipient of the service, are not establishments of direct person

So, in the case of the digital content creator, the supply place is in India, and the receiver of the service is Google Asia Pacific, Singapore.

This makes the service that you provide as a digital creator as an exporting service hence, liable to no GST taxation.

How to File GST for AdSense Income?

You can follow this step to file GST for AdSense Form-

Step-1 Generate Invoice

- The very first step is to generate an invoice against the service that you’ve provided to Google Asia Pacific, Singapore

- The invoice must be appropriately raised as per the GST rules by mentioning the invoice number, date of invoice, the value of services offered, and the GST rate, among others.

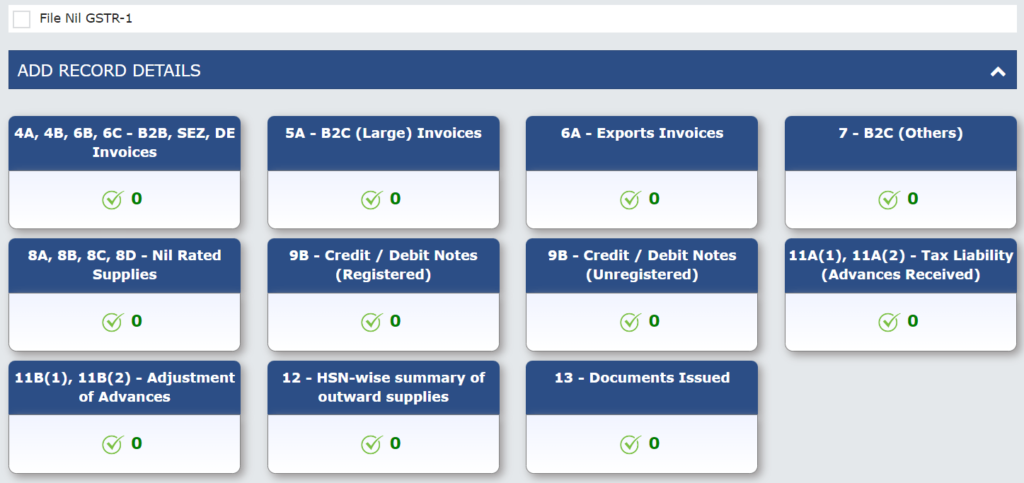

Step-2 Upload the Invoice Details in GST Portal

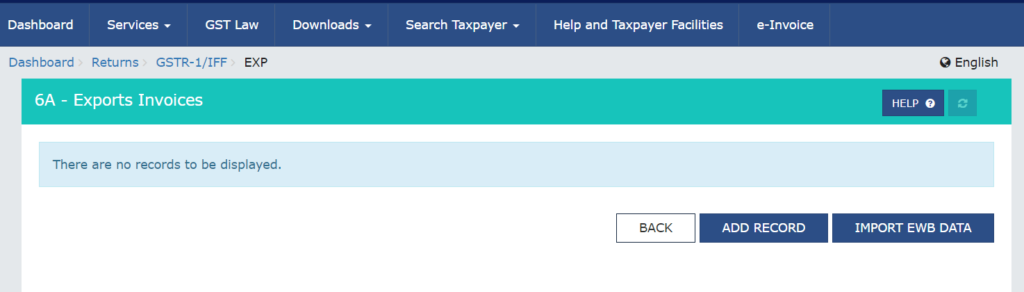

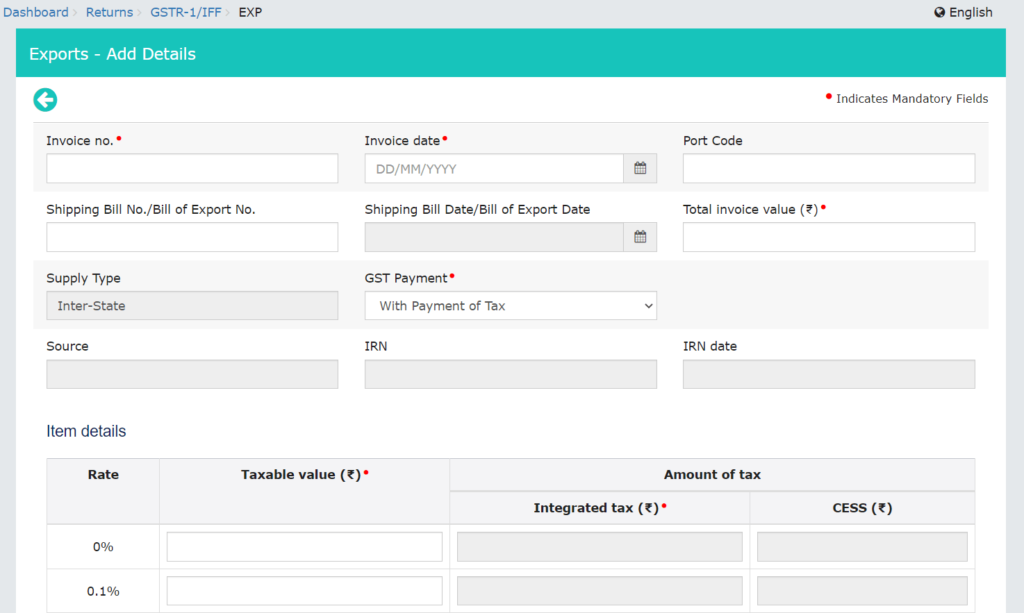

- Now, you’ll have to login to your GST portal and upload the invoices generated under section 6A Export invoices

- You can find the 6A column in the GSTR-1 form and the GST Payments should be set to Without Payment of Tax

- Make sure to correctly mention the Fill other details like Invoice No., Invoice date, Total invoice value, etc.

- In the Item detail section, under the Taxable value column, put the total invoice amount in the row with 0 Rate.

Should Digital Creators Apply for GST?

If the income from AdSense exceeds Rs.20 Lakhs per year then, yes, the digital creator must apply for GST as a part of compliance. Also, they will have to generate invoices in the name of Google AdSense for Singapore addresses i.e., Google Asia Pacific, Singapore.

It is not necessary to send these invoices to Google but, you’ll have to generate the invoice for compliance and accountability.

Do I have to pay GST for Google AdSense Income?

Although you’ll have to generate invoices if your income is more than Rs.20 Lakhs, you do not need to pay any GST on the invoices neither you are required to send these invoices to Google Asia Pacific.

The generation of the invoice is purely for compliance purposes and does not serve any taxation liability on you.

When will Digital Creator be liable for GST?

The digital creator is liable for GST only if he provides his service to an Indian company. You are only liable for GST exemption if you are exporting your services to a foreign company in this case, Google AdSense Asia Pacific.

If the digital creator earns money by providing service to affiliate marketing or sponsored ad to an Indian company then that money will be taxable under the GST regime.

If the taxable income is more than Rs.20 Lakhs then you’ll have to apply for GST. The GST applicable in this type of service is 9% CGST + 9% SGST or 18% IGST.

In case of the GST is not applicable, the digital creator has to export his service by signing a bond or letter of undertaking in form RFD-11 without paying GST or the digital creator must pay GST later to claim it as a refund.

Digital Creators with GST holders, must file GSTR-1 and GSTR-3B just like any other regular taxpayer.

FAQ

Yes, YouTubers and Bloggers can opt for the GST composition scheme available for the service providers only if the income from the service is up to Rs.50 Lakhs.

Yes, digital creators, can opt for the Quarterly Return filing and Monthly Payment of taxes (QRMP) scheme which has less compliance burden.

It depends on the registration of the service-receiving company. If the service-providing company is registered in India then yes, it will not be considered an export hence, GST is applicable. If the registered company is of any other country then no GST will be applicable.

Yes, ITC can be claimed by the Digital Creator if he/she is registered with GSTIN only with valid GST invoices with GST.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.