According to United Nations, India has the largest diaspora living in foreign countries. Not only that, According to World Bank, India is the largest receiver of foreign remittances in the world with $85 billion in 2020.

Now, both of these data are important in understanding the requirement of international banking services for the banks in India.

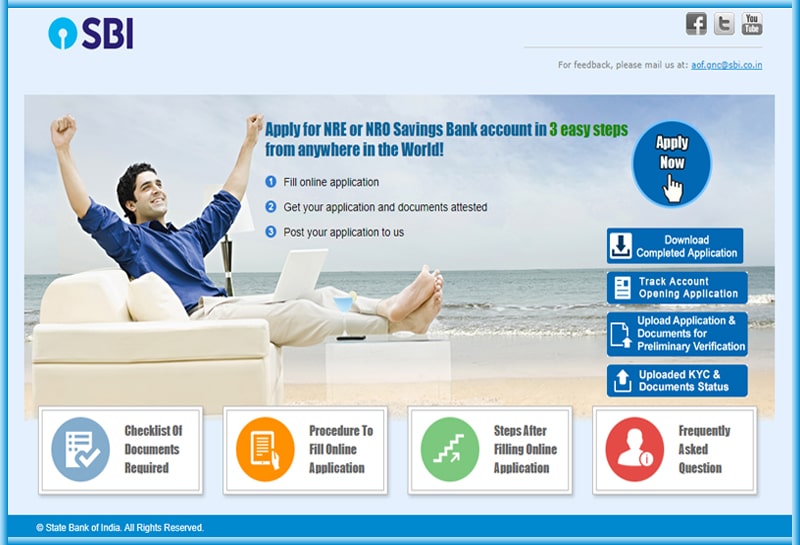

SBI being the biggest bank in India offers customers NRI account for Indians living in foreign countries. You can also access your NRI account online using SBI Net Banking.

SBI has a total of 52 foreign branches in almost every major city to offer banking services to the NRI Indians. In this article, we will discuss how to open an NRI account in SBI using both online and offline methods.

But first, let’s find out what are the features of the NRI Account?

Table of Contents

NRI Account Features

The following are the features that make NRI Account different from other accounts-

- Convenient Money Transfer to India- Using NRI Account, you can easily remit funds from overseas to India and you also get attractive exchange rates for fund transfer

- Good Interest Rates- NRI Accounts offers better Interest rates for the funds that you keep in your bank account

- Easier operations within India-NRI Account can be easily operated within India even when you live abroad. You can enable Joint operations of your NRI Account by joining your parents, spouse, siblings, relative, etc. The joint account holder also gets his/her ATM Card, Cheque book attaches to your account using which they can jointly operate the bank account.

Documents Required for NRI Account in SBI

The following are the documents required for NRI Account opening in SBI-

Proof of Status

- Valid Job Contract

- Continuous Discharge Certificate (CDC)

- Expired contract letter

- Last payslip evidencing employment with a shipping company

- NRI Certificate

Proof of Permanent Address

- Relevant pages of Passport

- Driving License

- Voter Identity Card

- Aadhaar Letter/Card

- NREGA Job Card

Proof of Identity

- Relevant pages of Passport

- Aadhaar Card

- Government-issued National Identity Card at the country of residence

- driving License issued abroad

- Utility Bill (Electricity, Telephone, Gas)

- Employer’s certificate

- Address proof of the blood relative

Other Documents

- 2 Passport size photographs

- Certified English translated copy of the document wherever it is in a foreign language

- Proof of Income / Pay Slip / Tax return

SBI NRI Account opening process

You can open NRI Account in SBI using both online and offline methods which are as follows-

Online

- Visit the official website of SBI NRI account opening by following this link- https://oaa.onlinesbi.sbi/oaonri/onlineaccapp.htm

- Now, click on the “Apply Now” button followed by clicking on the start now under the Customer Information section

- Now a form will appear which you have to fill with correct information followed by clicking on proceed button

- After clicking on the proceed button was created an NRI Customer Reference Number (NCRN) will be generated which you can use to track the application

- Now, you have to fill the Applicant Information section with correct details and make sure you have mentioned your NCRN number to connect your account

- After filling in the details, you have to submit the documents by clicking on the proceed button

- A new reference number will be generated NRI Account Reference Number (NARN)

- Now, your application form is filled, now, you’ll have to submit the completed application form to the bank via post

- Before sending the application form with attested documents to SBI global bank branch, you are advised to verify your documents using a preliminary verification link where you have to upload the scanned image of all the documents

- If preliminary verification is successful, you can send your documents to SBI via post

- You’ll be notified about the documents recevable and your request will be processed

- After processing your account, you’ll receive a starter’s kit using which you can access your bank

- After receiving the starter’s kit, you can activate your SBI Debit card, SBI NRI net banking, and mobile banking by generating pin for SBI debit card

Offline

- Visit the SBI Bank Branch and ask for the NRI Account opening form

- Now, fill the form with correct information

- In whichever country you are living, visit the Indian Embassy there or visit the online website of that embassy and ask for attestation of the documents mentioned above. A small fee will be charged for attestation.

- After attestation, you have to submit the application form and attested documents to the bank representative or send it via post to the SBI Global Bank branch

- Now, your application form will be processed and documents will be verified. After successful verification of the documents, your NRI account will be opened and you’ll receive your SBI NRI welcome kit will be sent to your permanent address

How to Track your SBI NRI Account Opening Application Status?

You can track your SBI NRI Account opening status by following these steps-

- Visit the official website of SBI NRI account portal and click on the track application status button

- Now, a page will appear where you have to enter your passport number, Date of Birth followed by clicking on the confirm button

- You’ll find the NRI Account opening status on your screen

FAQ

The interest rate offered on NRI Account by SBI is-

Saving Deposits Balance up to Rs. 1 lakh, the rate of interest is 2.70% p.a

Saving Deposits Balance above Rs. 1 lakh, the rate of interest on entire balance is 2.70% p.a.

The following are the minimum balance required by an individual to maintain for SBI NRI Account-

Branches

The average Minimum Balance for Metro/ Urban Branches is Rs.3,000/-

The average Minimum Balance for Semi-Urban Branches is Rs.2,000/-

The average Minimum Balance for Rural Branches is Rs.1,000/-

No, account opening applications and documents cannot be submitted via email. You have to either be physically present or send it through courier/post.

You can submit your documents and application form via post or can visit your nearest SBI NRI Global branch and submit your documents there.

While filling out the application form online, you’ll also receive an email with NCRN and NARN details, you can recover your NCRN and NARN number from your em

You can attest your application and KYC Documents from the following-

SBI Foreign Office

Notary Public

Indian Embassy or High Commission

No, you cannot convert any account into an SBI NRI/NRO account. You have to apply for a new NRI/NRO account followed by closing your resident Indian savings account if not required.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.