Unified Payment Interface is a payment system introduced by the NPCI back in 2016 which made online payments very easy. With the introduction of this new system, India has become the country with the highest number of transactions done per year. UPI system has multiple features which makes it super useful for a user. One of the features is that it can be used without the internet.

Many times, UPI transactions can be failed due to poor internet connection but, UPI also has a USSD Code-enabled payment system that uses your mobile network to provide you banking services. In this article, we will discuss How To Make UPI transactions without an internet connection using USSD Code.

The UPI USSD Code transaction system is available in various regional languages and the dialing code for choosing languages is as follows-

It is available in 11 regional languages and can be accessed in the desired language using the following shortcodes.

- English (*99#)

- Hindi (*99*22#)

- Tamil (*99*23#)

- Telugu (*99*24#)

- Malayalam (*99*25#)

- Kannada (*99*26#)

- Gujarati (*99*27#)

- Marathi (*99*28#)

- Bengali (*99*29#)

- Punjabi (*99*30#)

- Assamese (*99*31#)

- Oriya (*99*32#)

Table of Contents

Get Started with USSD Banking

USSD Banking is an innovative approach for providing banking services using a mobile phone. It is an inclusive mobile banking facility as this service can be availed using a feature phone also. To get started with USSD Banking, the customer has to contact the bank regarding the activation of the mobile banking facility on your bank account. Also, the candidate should have a registered mobile number with the bank.

Now, to activate the USSD Banking, you can follow these steps-

- Using your RMN, dial the USSD code on your mobile dialing pad and press the call button

- A welcome screen will appear, here you have to enter the first three letters of the bank name, or IFSC code or 2-digit bank code followed by send

- This will verify your registration for mobile banking and once the verification gets confirmed

- Now the USSD Banking is activated for your bank and you can use the USSD Banking services seamlessly.

Services Offered by USSD

The following are the services offered through USSD code-

- Balance inquiry

- Mini Statement

- Funds transfer

- Change M-PIN

- Generate OTP

Steps to Use UPI USSD Code for Banking Services

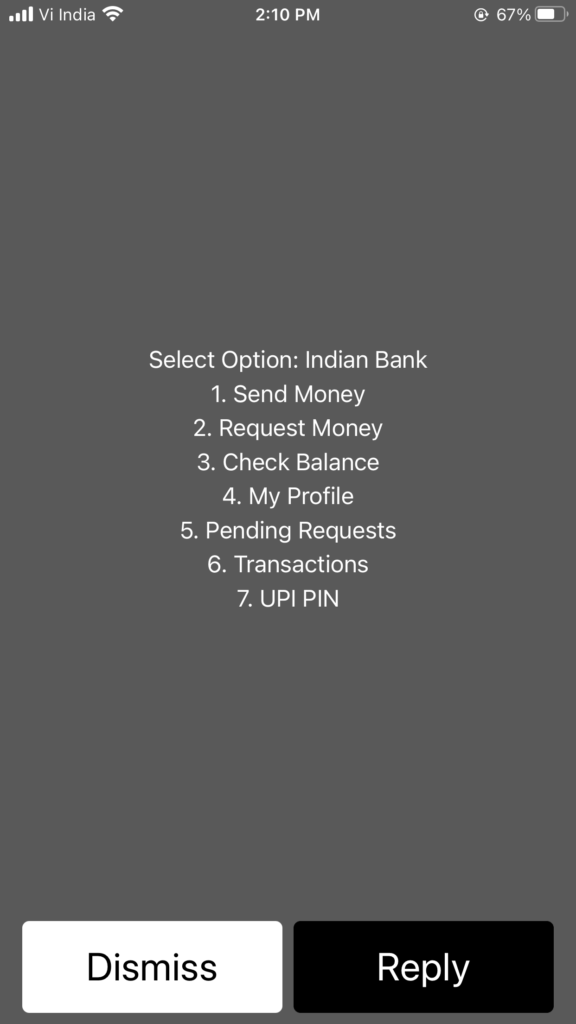

You can access the USSD Code banking services by dialing *99#. The following are the steps to use UPI USSD Code Services-

Sending Money

Now, there will be many options provided to you to choose from choosing the number-1 for sending money.

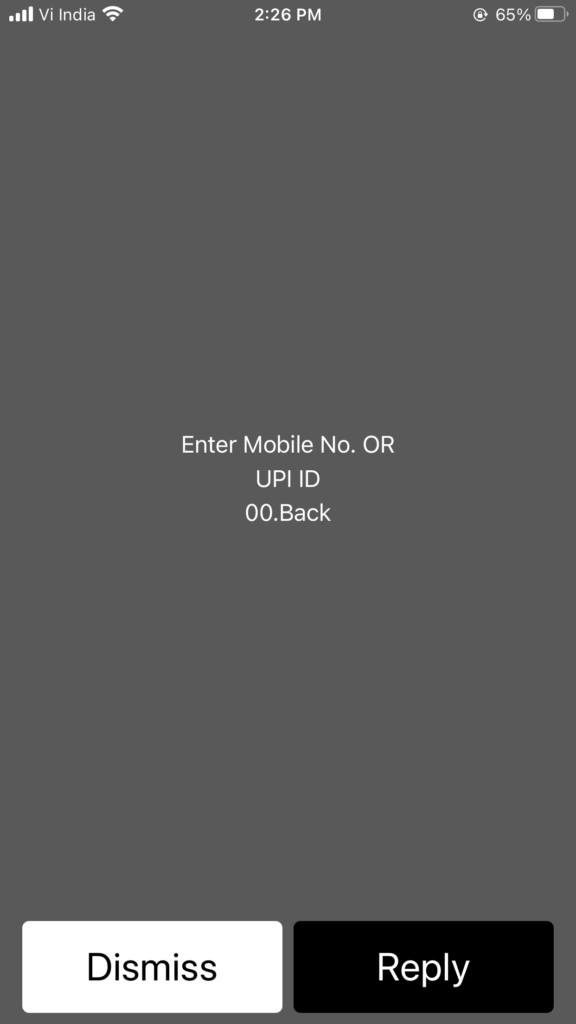

Now, you will be prompted with different options to send money-Mobile number, UPI ID, Saved Beneficiary, or IFSC + Bank A/c

You have to choose one of them by dialing in the associated number like for example mobile number press 1

Now, a new dialogue box will appear where you have to enter the details of whatever option you choose

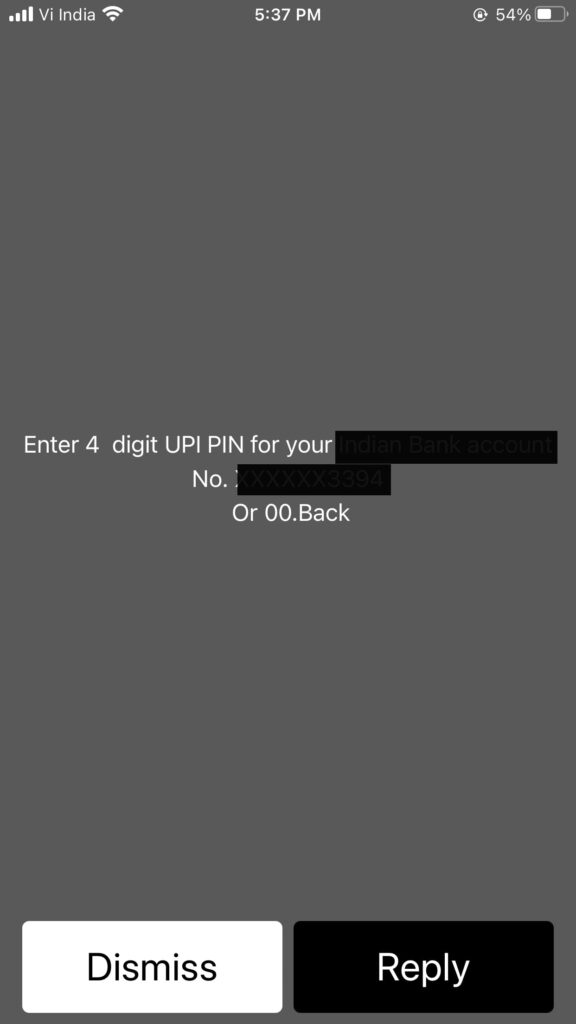

Now on the next screen, you have to UPI PIN and press reply

After entering the UPI PIN, your transaction will be successful.

Requesting Money

- Now there will be many options provided to you to choose from. To request money, you have to choose number-2.

- In the next step, you have to enter the mobile number or UPI Id of the person you are requesting money from

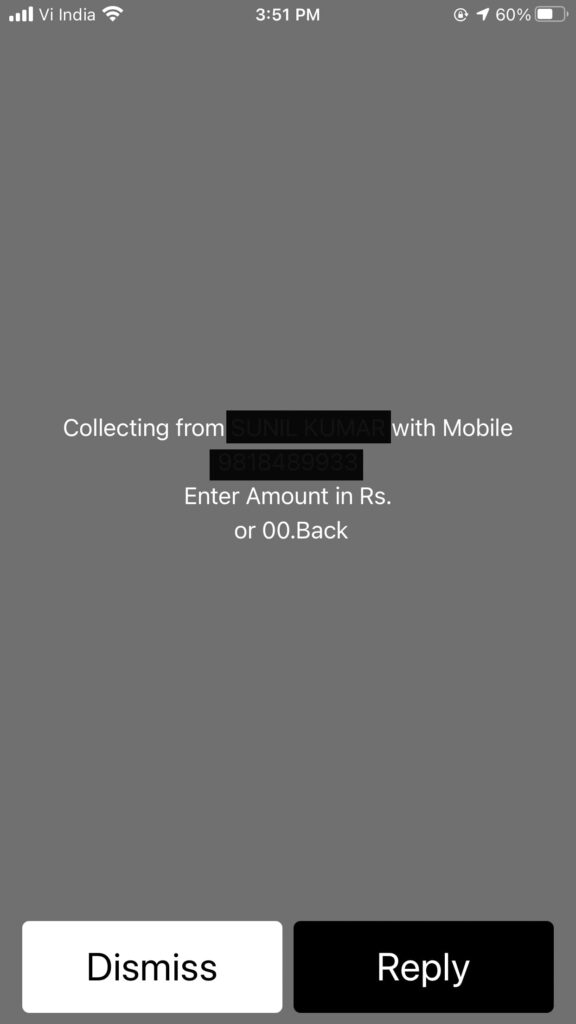

- Now, enter the amount that you want to request and press reply

- The person you are requesting money from will receive a notification via SMS, or if they are using the UPI app then it can be seen on the “approve to pay” section

- From there the person has to enter his/her UPI pin and complete the transaction

- Once, he/she complete the transaction, the payment will be reflected on your bank account

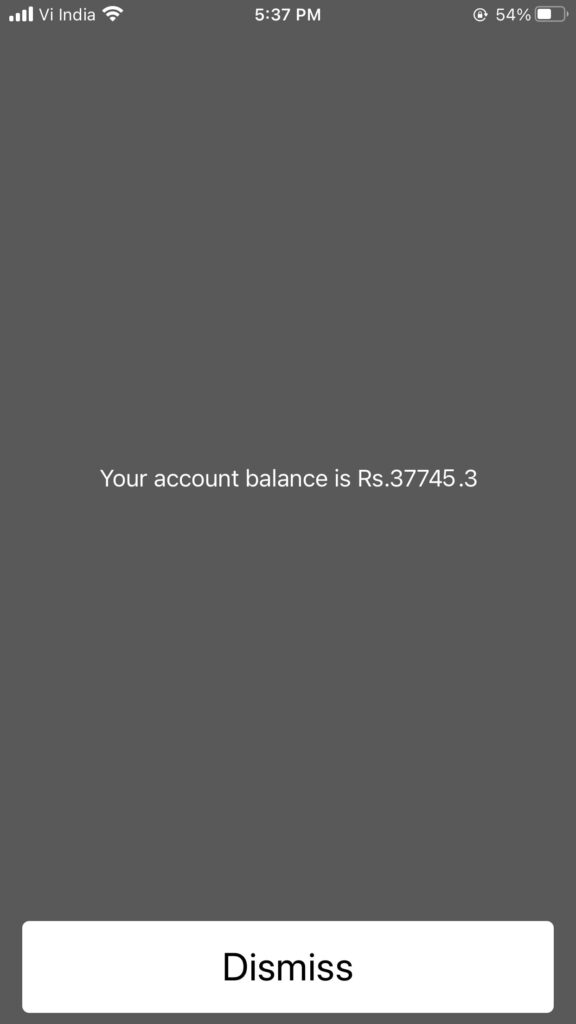

Check your Bank Balance using UPI

- To check your bank account balance using UPI, Open your mobile calling and dial in *99# from your registered mobile number

- Now there will be many options provided to you to choose from. To check your bank balance, you have to choose number-3.

- On the next screen, enter your UPI Pin and press reply

- After you’ve entered your UPI pin, the bank balance will be displayed on your screen

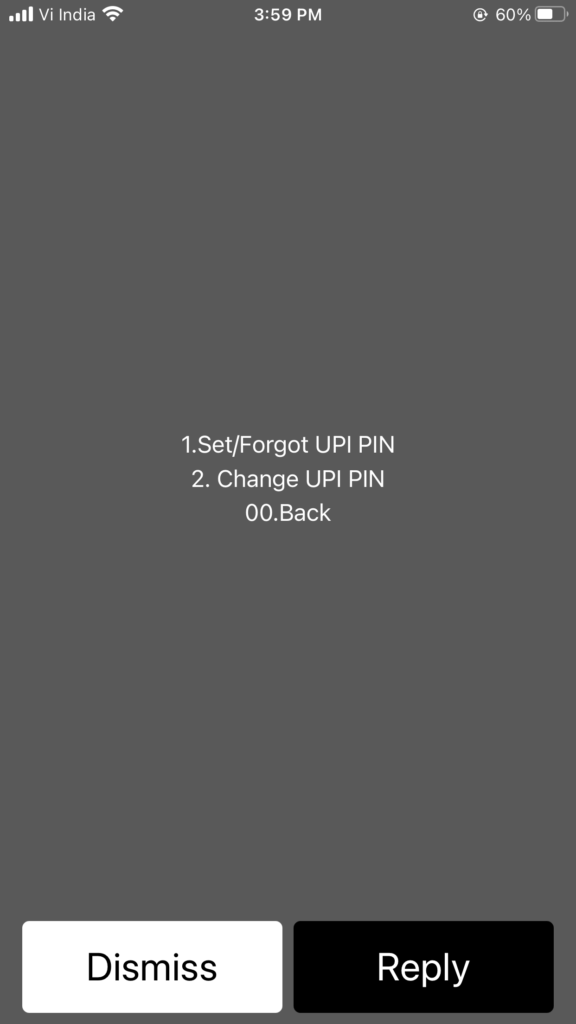

PIN Change

- Open your mobile calling and dial in *99# from your registered mobile number

- Now there will be many options provided to you to choose from. To check your bank balance, you have to choose number-4

- On the next screen, you’ll be prompted with two options-set/forgot UPI PIN and Change UPI PIN

Set/forgot UPI PIN

- Now, enter the last 6 digits of your debit card with the date of expiry separated by a single space

- Now enter the new UPI Pin followed by entering UPI PIN again

- After pressing reply, your UPI Pin will be set

Change UPI PIN

- If you know your old UPI Pin and want to set a new one then simply choose the second option

- On the next screen, enter your old UPI PIN followed by clicking on the reply button

- Now, UPI will confirm your UPI PIN, after that, enter your new four-digit UPI Pin and press reply

- Your new UPI pin is set successfully

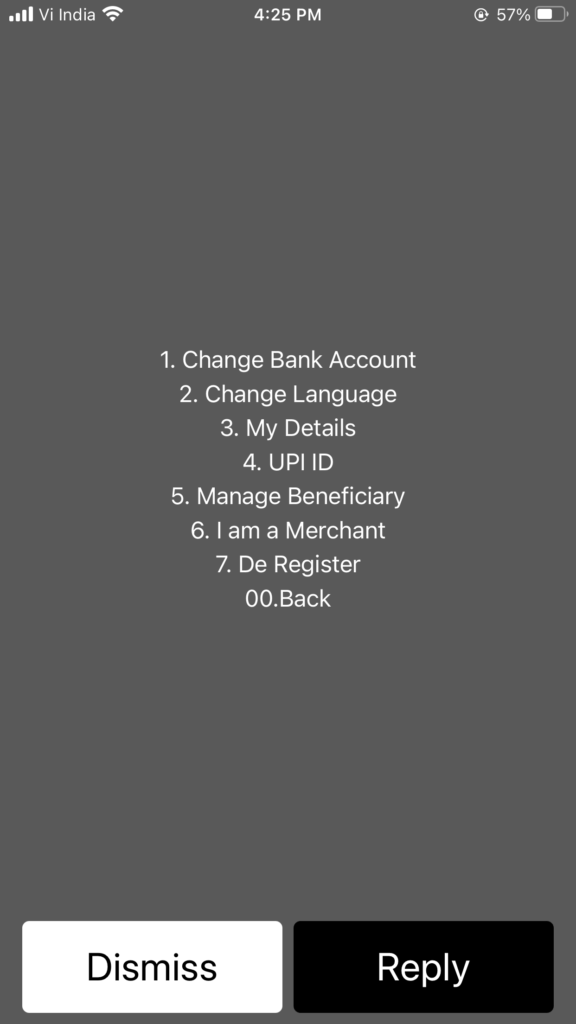

My Profile

- You can choose option no 4 if you want to change bank account, change language, view details, manage beneficiary, my queries, or add payment address

Pending Request

- You can enter the number 5 if you want to send a payment from a pending request

- After choosing this option, you’ll be prompted to enter a UPI PIN to authenticate the transaction or you can simply enter 2 to reject the request

- Now, the payment to the receiver will be initiated

Transactions

- If you want to view the last 5 transactions then you can choose option 6 and raise query /enter query for last 5 transactions of NUUP

- On the next screen, you will be shown the last 5 transactions in a numbered manner, choose the transaction that you want to view

- Now here, you can view the status of the transaction and raise a query if you want.

- On the next screen enter the queries and send it

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.